A report released by Afrinvest has revealed that three prominent brewers listed on the Nigerian Exchange (NGX) – Nigerian Breweries Plc, International Breweries Plc, and Guinness Nigeria Plc – collectively incurred historic pre-tax losses amounting to N254.8 billion in the 2023 financial year.

Furthermore, the report predicts a further 2.7% contraction in the industry’s sales volume for 2024. It estimates that if the foreign exchange rate averages at N1,057 per dollar in 2024, the industry’s average unrealized foreign exchange losses could range between N20 billion and N33 billion, compared to the N76.3 billion recorded in 2023.

The report, titled “Nigeria Brewery Sector Update: Turning the Tide on Bottled Gains?,” highlights the challenges faced by brewers due to increased raw material costs, business operating expenses in Nigeria, and the Central Bank of Nigeria’s interest rate hikes. To remain viable, brewers raised product prices by an estimated average of 25% across brand segments.

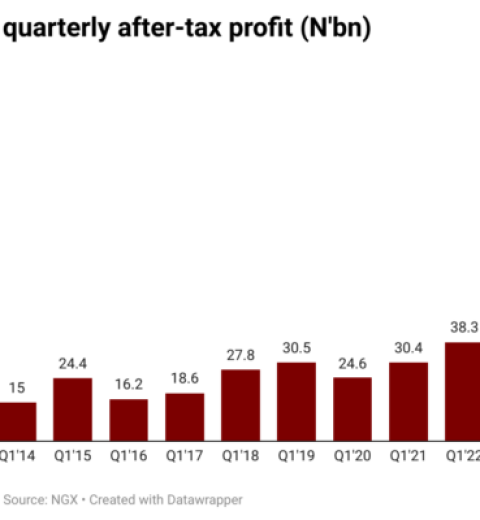

As a consequence, the industry witnessed a staggering 1,824.3% year-on-year decline in pre-tax profit (PBT) to a negative value of N254.8 billion, marking the first time all three major brewers reported significant losses. Despite a modest 12.0% year-on-year growth in sales revenue to N1.1 trillion, estimated sales volume dropped by 5.0% to 18.9 million hectoliters (mhl) in 2023.

The report further analyzes the industry’s key cost elements, such as the cost of goods sold (COGS), operating costs, and financing costs, which significantly impacted profitability. COGS surged 15.9% year-on-year to a record-high of N749.5 billion due to factors like increased production input costs, excise tariff hikes, exchange rate fluctuations, and supply chain disruptions caused by the Russia-Ukraine war.

Operating costs saw a 10.2% and 3.1% year-on-year increase in administrative and marketing/distribution costs, respectively, while finance costs skyrocketed by 461.1% to N119.1 billion, reflecting negative exchange rate movements and tighter interest rate environments.

Despite increasing leverage to sustain operations, the industry’s average leverage ratio deteriorated from 0.43:1.00 in 2022 to 0.71:1.00 in 2023. Looking ahead, the report anticipates potential tax hikes on alcohol products to augment government revenue, alongside opportunities for brewers to expand sales to neighboring countries under the African Continental Free Trade Area (AfCFTA) agreement.

Stay updated and stay ahead of the game! For more instant updates, breaking news, and exclusive content on business news, follow Lagosstate.com. Don’t let any headline slip by!