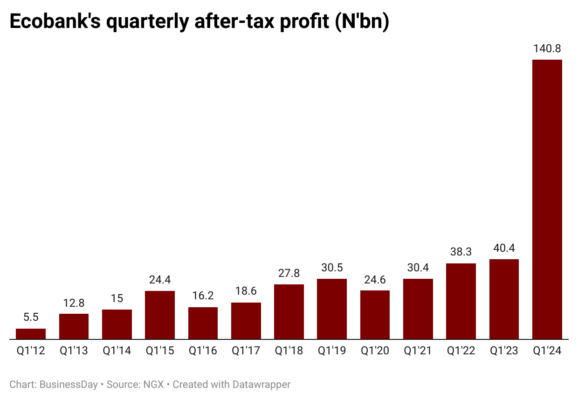

According to its latest financial statement on Tuesday, the earnings of Ecobank Transnational Incorporated (ETI), a pan-African banking conglomerate, increased by 249 percent in the first three months of 2024.

The group reported a significant increase in after-tax profit, rising from N40.4 billion in the first quarter of 2023 to N140.8 billion.

Interest income, calculated using the effective interest rate, saw a substantial rise to N608.2 billion from N207.2 billion. Conversely, the bank’s interest expense surged by 160 percent to N219.9 billion from N94.5 billion due to the high-interest rate environment.

Further analysis of the financial statement revealed that Ecobank’s interest income grew by 194 percent in Q1, with all major contributing lines experiencing an increase: investment securities (248.5 percent), loans and advances to banks (260.4 percent), loans and advances to customers (178.7 percent), Treasury bills and other eligible bills (144.3 percent), and other investments (133 percent).

The bank recorded a 217 percent growth in net interest income, reaching N388.3 billion in the first quarter of 2024 from N122.6 billion in the same period of 2023. Additionally, net fee and commission income increased to N18.7 billion from N5.7 billion during the period.The bank also seemed to have gained from the Naira devaluation as Trading income and foreign exchange gains surged 202 per cent to N107.1 billion in the first three months compared to N35.4 billion in the same period last year.

In Q1’24, ETI’s operating expenses totaled N357.9 billion, marking an 181 percent increase from N127.5 billion in the same period of 2023. This rise was primarily fueled by staff expenses, which amounted to N152.4 billion, reflecting a 178 percent increase from N54.8 billion.

Depreciation and amortization expenses reached N24.8 billion in the first three months of this year, representing a 126 percent increase from N10.9 billion in the corresponding period of 2023.

However, operating income stood at N665.4 billion, indicating a 205 percent increase from N217.8 billion.

Cash and cash equivalents at the end of the period surged to N5.2 trillion from N1.12 trillion. The movement in cash and cash equivalents reveals that net cash generated from operating activities reached N135 billion from a negative N491 billion.

Net cash generated from investing activities amounted to N477 billion, compared to a negative N82.8 billion, while net cash generated from financing activities totaled N208 million, down from N73.3 billion.

Ecobank’s basic and diluted earnings per share increased to N374 in the first three months from N117 last year.

For more business news,visit..lagosstate.com